The Centers for Medicare & Medicaid Services (CMS) published revised guidance on the Medicare Prescription Drug Inflation Rebate Program. That program was established under the Inflation Reduction Act (IRA), which requires drug companies to pay a rebate to Medicare if they raise their prices for certain drugs faster than the rate of inflation.

Specifically, IRA established inflation rebates for single-source drugs and biologicals under Medicare Part B and provides for lower Part B beneficiary coinsurance on such drugs and biologicals. The law also establishes inflation rebates for certain drugs and biologicals under Medicare Part D.

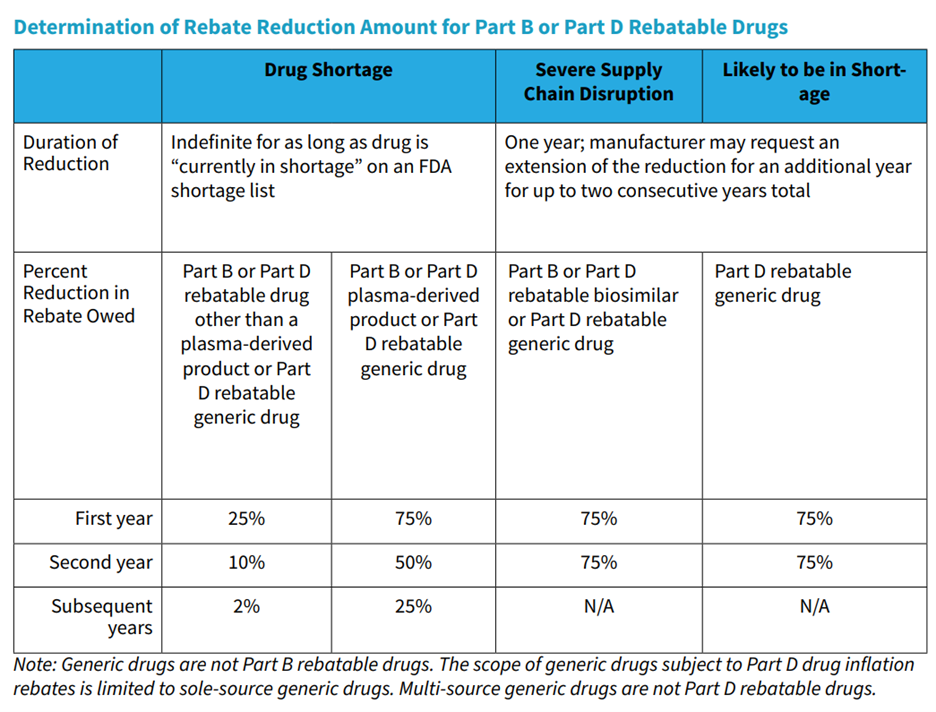

The revised guidance lays out specific parameters for how CMS may adjust rebates for drugs in shortage, or at risk of going into shortage. The revision comes in response to public comments received on the Initial guidance on the program, which was published February 2023. Additional details follow.

Inflationary Rebates and Drug Shortages

For a Part B or Part D rebatable biosimilar or Part D generic drug facing a severe supply chain disruption, or a generic Part D rebatable drug likely to be in shortage, the drug company may request a rebate reduction. Per CMS:

“To calculate the reduction in the inflation rebate amount for a rebatable Part B or Part D drug currently in shortage, CMS will first determine the number of days such drug is described as ‘currently in shortage’ on an FDA shortage list during the period for which the rebate is being assessed (i.e., calendar quarter for Part B or 12-month applicable period for Part D). CMS will then divide that number by the total number of days in the calendar quarter or 12-month applicable period. CMS will multiply that amount by a percentage that is decreased over time.”

The table below provides the reduction percentages for Part B and Part D rebatable biosimilars and generic Part D rebatable drugs that face a severe supply chain disruption, and for generic Part D rebatable drugs that are likely to be in shortage.

Inflationary Rebates, 2022 – 2025

October 1, 2022, was the start of the first 12-month applicable period for which drug companies will be required to pay rebates to Medicare under Part D. January 1, 2023, was the start of the first quarter for which drug companies will be required to pay rebates to Medicare under Part B. April 1, 2023, marked the first time that beneficiaries with Traditional Medicare and Medicare Advantage saw a lower coinsurance for certain Part B drugs if the drug’s price increased faster than the rate of inflation in a benchmark quarter.

CMS also released lists of the 48 Part B drugs that will be impacted by reduced beneficiary coinsurance for the first quarter of 2024 and the 47 drugs that experienced adjusted coinsurance in 2023.

Bookmark ASCO in Action for updates on IRA implementation, as well as news, advocacy, and analysis on cancer policy.